If you’re considering building your own home or renovating an existing property, you may be wondering what the requirements are for obtaining a construction loan. To help answer your questions, we’re answering our most commonly asked questions about construction financing. We’ll cover topics such as what you need for a construction loan, credit scores, down payments, and more, as well as discussing the benefits of a construction loan over a traditional mortgage loan. This article will provide you with the information you need to make informed decisions about your construction financing options.

What is a construction loan?

A construction loan is a two-phase mortgage loan that provides funds for building a residence, and once construction is complete, functions like a traditional mortgage loan.

In the first “construction” phase, payments made are interest-only, based on how much has been drawn and spent from the total available funds. This is designed to make the construction process less expensive. This phase can last 6, 9, or 12 months.

During the second “permanent” phase, the loan becomes structured like a typical mortgage with principal and interest payments.

How do construction loans work?

Here’s where it gets interesting! With other creditors, the two-phase process typically means that there are two sets of appraisal and closing costs associated with construction loans. But at Kennebunk Savings, we use the “as-complete” value determined before construction for a one-time closing! This can save you both time and money.

In some cases, construction loans have a limited number of “draws” for funds, which means you and your builder must also work with the creditor’s schedule. At Kennebunk Savings, we do not limit draws, to give you more flexibility.

Do I need to own the land already to seek a construction loan?

Sometimes, a person seeking a construction loan already owns the land in question, but a land purchase can be packaged together with a construction loan.

What credit score is needed for a construction loan?

The credit score and other requirements for a construction loan vary by case! Talk to a lender about it!

Is a construction loan harder to get than a traditional mortgage loan?

It can be! But really, it’s just that Construction Loans tend to have more moving parts – and we’re not just talking about the excavators! It can sometimes require more liquid assets to complete – cash for closing or demonstrating proof of reserve funds for bigger projects.

What are the benefits of a construction loan over a traditional mortgage?

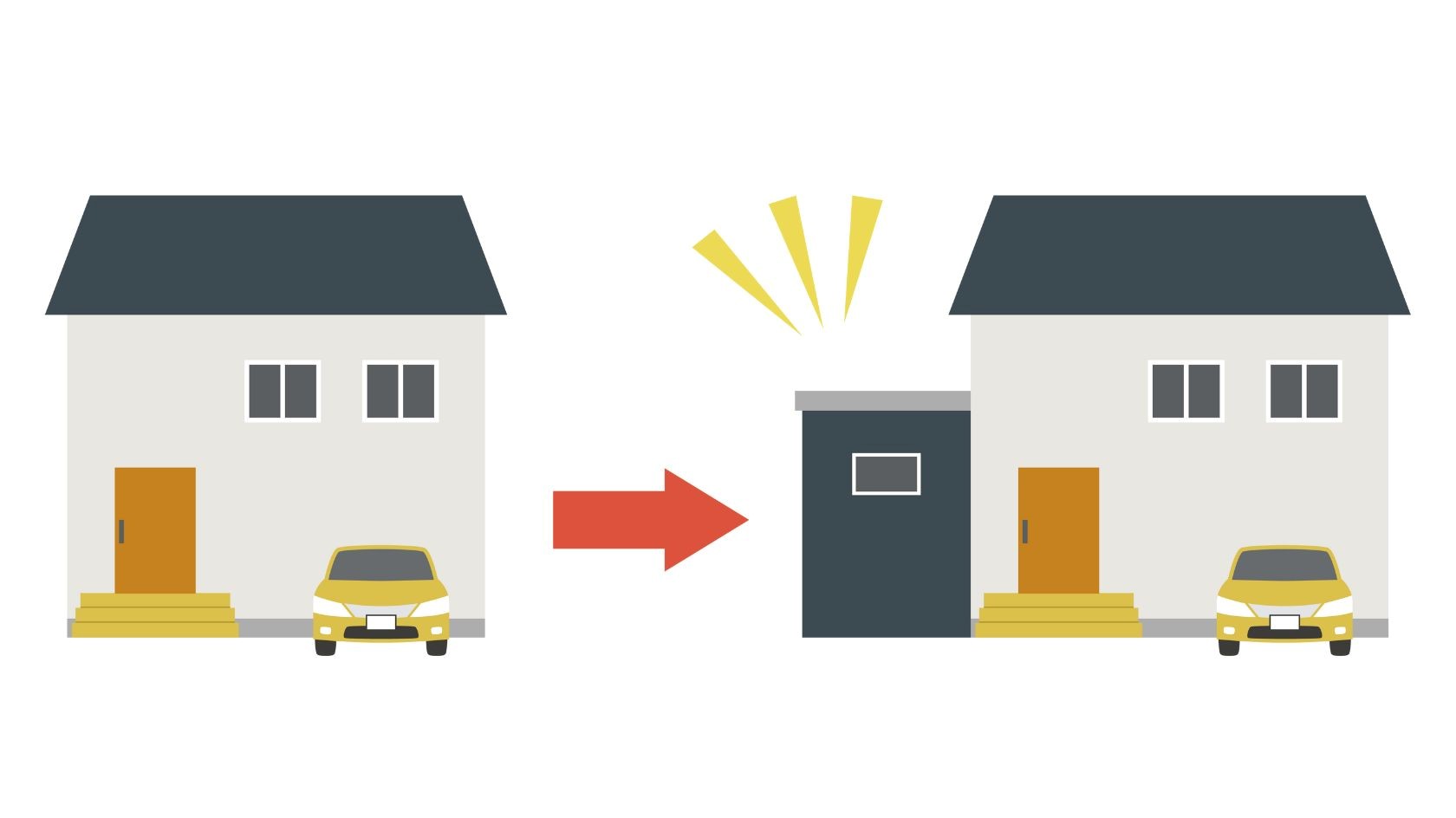

A construction loan can assist you with getting the funds necessary to build a new home, compared with a traditional mortgage, where you’re purchasing an existing home. Construction loans are also good for completing more extensive renovations to your home. With a construction loan you can utilize what your home’s value will be when the renovations are complete instead of relying on the current value of your home for equity to refinance a traditional mortgage, or obtain a home equity loan.

How much of a down payment is required for a construction loan?

The down payment amount and other requirements for a construction loan vary by case! Talk to a lender about it But it’s worth noting that if you own land, you can sometimes leverage the equity in that land to help support a down payment!

Can I use equity on my current home for a construction loan?

Yes, depending on the scenario! Here’s that link to talk to a lender one more time!

All loans are subject to credit approval.