As your teen begins the transformation into adulthood, learning to successfully manage her finances becomes an important step in helping her gain financial independence. To prepare your teenager to leave home for the first time, consider providing her with opportunities to manage money while she is still under your roof. This will allow you to offer guidance and a good foundation for successful money management down the road.

Here are the top 5 money management tips to teach your college-bound teen:

1. Teach Your Teen To Save

A good rule of thumb is to talk to your teen about setting aside at least 50% of all earnings and gifts for a savings account. The other 50% is for living and spending. Encourage your teen to save by setting savings goals and timeframes and even offering an incentive as a reward. If you are able, help boost her savings by contributing a certain percentage of what is saved or a preset amount to the account if the savings goal is met. Whatever method you choose, talk with your teen to determine what will motivate her to save.

2. Teach Your Teen How To Create a Budget

Start by practicing how to stay within a budget. Create a goal of saving for something she wants based on an allowance or her earnings. Help your teen prepare a detailed plan on how to get to that goal by using a spreadsheet program, free online budgeting software or one of the many budgeting apps that might appeal to your (likely) tech-savvy teen.

3. Teach Checking Account Responsibility

A parent will likely have to co-sign for a minor when opening a checking account. If you have a responsible teen, she might be ready for a checking account.Compare different types of checking accounts and highlight the benefits of having a free checking account, such as one with no minimum balance fee and free ATM use. Use a comparison chart like this one to compare the differences between checking accounts.

Go over the basics of a checking account: making a deposit, writing a check and checking the available balance, monitoring account activity, and reconciling the account each month. Make sure your teen understands any fees and repercussions associated with bounced checks and overdrawing the account. Some banks offer account alerts via text or email to warn account holders if the balance drops below a certain threshold or if the account is at risk of being overdrawn.

Finally, teach your teen how to use online banking so she can closely monitor her account activity in real-time and set up alerts so she knows if funds are being removed from her accounts.

4. Teach Your Teen To Use a Credit Card Responsibly

Teach your teen to use debit cards and credit cards to spend within their budget. Encourage her to view paying for items using a credit card the same as if she used a debit card, which will help her with budgeting and paying the bill in full each month.

The key to establishing good credit is vigilance in paying the credit card bill on time and paying it in full each month. Teach your teen the basics of how a credit card works, and most importantly, explain how interest is charged on debt as well as how easy it is to get trapped in a cycle of paying toward interest. It’s critical that your child understand how a credit card affects their credit history. That history will affect not only whether she is approved for future credit cards, car loans or mortgages, but it will also affect the interest rates she will be charged on each product.

5. Protect Financial Information

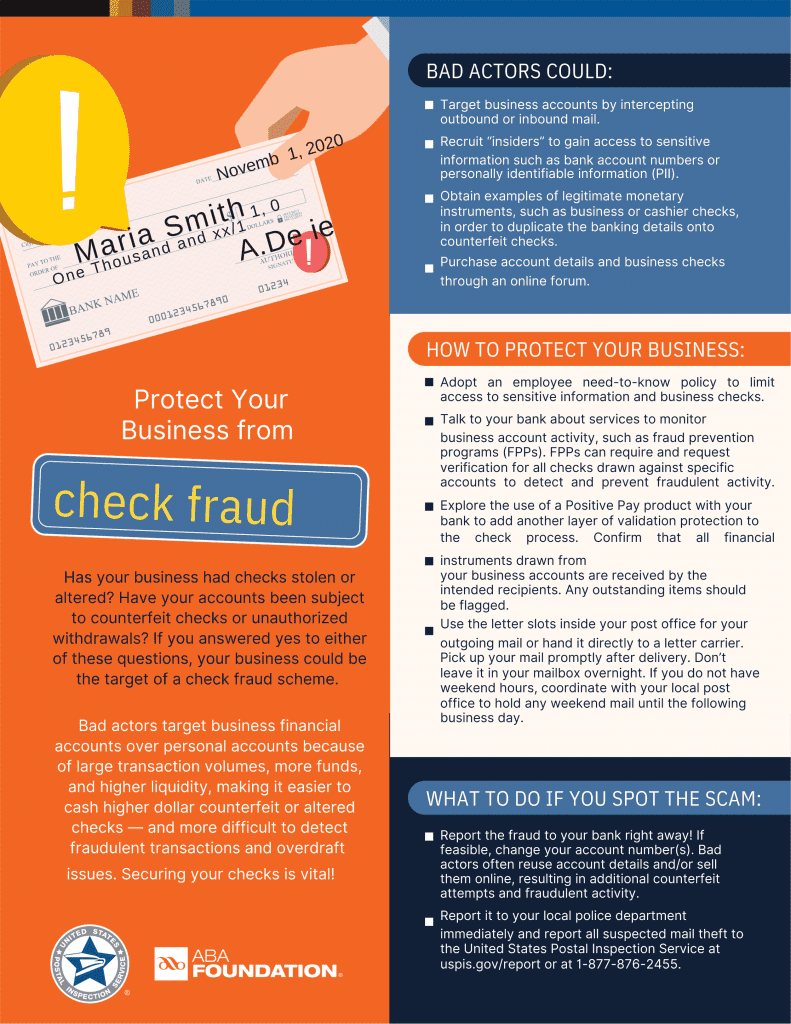

Even though financial fraud is a growing and newsworthy trend, some children aren’t aware of the risks associated with sharing their credit cards with their friends or logging into their financial accounts on public computers and apps through public Wi-Fi. Work with your teen to take reasonable measures to ensure that their user IDs, passwords and other information is protected. This also includes making purchases online. Using a debit card for online purchases makes an individual far more vulnerable than using a credit card. Once a thief obtains debit card information, they can quickly drain a bank account. On the other hand, credit card companies typically offer fraud liability guarantees and provide consumer protection once they’ve been notified that something is amiss.

Most importantly, talk openly with your teenager. Use your personal money management experiences to connect. Sharing your mistakes or struggles with your own finances can create real world lessons for your children. Teach your teen about the consequences of those actions and use your real-life training as education and motivation to provide for a bright financial future.

If you need help, Kennebunk Savings is here to answer your questions. Stop by one of our convenient locations or reach out to us at 1-800-339-6573.