If you run a seasonal business you already know the ins and outs and ups and downs that make managing cash flow such a balancing act—particularly during the off-season. Here are a few tips for seasonal businesses, to help keep cash flowing in the right direction all year long.

1. Plan For Success

While you can’t predict everything, developing a cash flow forecast and corresponding budget will help you to see the big picture—when you have the most income and when you can expect your biggest expenses. Businesses that have the best understanding about their cash inflows and outflows are the ones that are most likely to succeed.

2. Take Control of Cash In

One of the best moves you can make to increase cash management efficiency is to take advantage of any mobile deposit or remote deposit capture services offered by your bank. The ability to make business deposits without going to a branch, whether you’re in the middle of the busy season or traveling during the off-season, is crucial to making sure your money is available and accessible whenever you need it.

3. Stay on Top of Cash Out

The same goes for managing outgoing funds. Setting up automatic payments can help ensure you never miss a bill, no matter what season it is. We encourage small businesses to utilize online account access and bill payment services, to keep cash flowing as efficiently as possible.

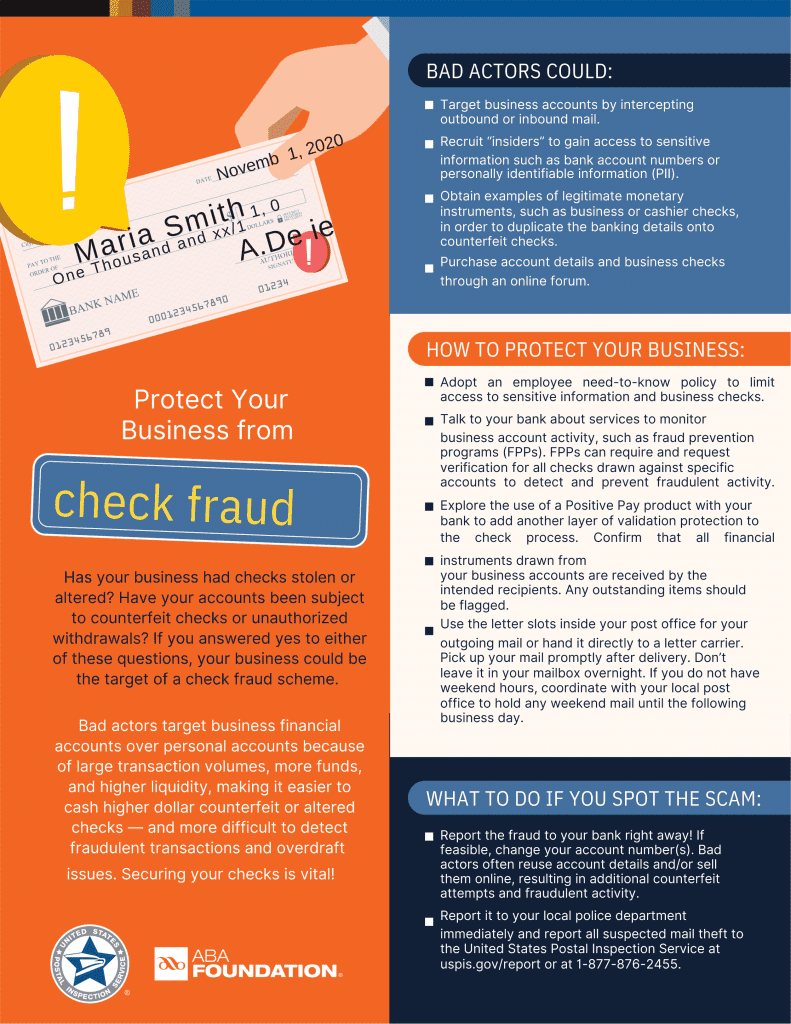

There’s also the question of security and verification with outgoing funds, which is why Positive Pay can be incredibly useful for seasonal business owners. Positive Pay ensures that all information on a check presented for payment must match your file of issued checks or the bank will not pay without authorization.

Having the most accurate, up-to-date information about your accounts is key to effective cash management in any business, but particularly in seasonal businesses where you make most of your profit during just a few months of the year. That’s why you need the most up-to-date banking tools to help you stay on top of your cash flow needs. In addition to the tools mentioned above, consider setting account alerts for deposits and withdrawals, so that you’re immediately notified when there’s a change in available funds.

4. Where You Can, Delegate Responsibilities

We know that you wouldn’t trust just anyone to help you manage your business! Delegating certain aspects of cash management can help you stay focused on the day-to-day responsibilities of running the business and make sure all payments and deposits are made on time.

It’s prudent to partner with a financial institution that provides tools to manage and set controls for your online banking and payment systems. Customize access for your bookkeepers or business manager, so that you can control access levels (who has access to which accounts) and times (when they have access to your accounts).

As part of security best practices, you want your employees to be able to perform their job functions within your business hours.

5. Take Steps to Lower Overhead in the Off-Season

During the off-season, seasonal business owners can take a few simple actions to save money, such as reducing business hours and lowering staffing requirements.

You may also want to consider negotiating any ongoing services or lease agreements so that you can pay more during the busy season when cash is flowing, and less in the off-season. Talk to your service providers about your limited needs in the off-season—maybe you can temporarily halt internet service to an unused shop location. Taking these steps can help you plan well ahead of time to ensure that you’re prepared for a less lucrative season.

6. Set Up a Line of Credit

When running a seasonal business, you may need a line of credit to ensure that you have funds on-hand during the slower revenue periods. It’s important to work with a financial institution that encourages the cash management and the business lending teams to work closely together so that your seasonal business has access to the many financial services that exist.

If you’re a seasonal business owner who isn’t yet taking advantage of the tools discussed above, call Kennebunk Savings at 1-800-339-6573.