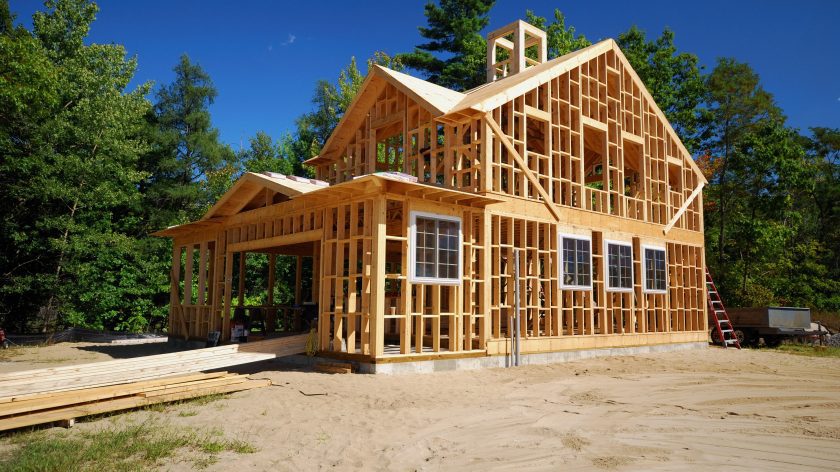

You’ve got land? We’ve got a construction loan for you.

Are you already dreaming of the fun stuff that comes with that piece of land you saw – the kitchen counters, the bay windows, a cozy fireplace? With a Kennebunk Savings construction loan, you can roll the financing to purchase the land, construct a home and finance the permanent structure mortgage and keep looking ahead. Lock in a fixed interest rate even before you break ground, and enjoy interest-only payments during the initial phase of construction to easily manage expenses, like the costs of alternative housing while you build.

What are the benefits of construction loans?

- Single loan closing at the beginning of construction can save you money and time

- Finance up to 90% of the value of your primary residence

- Gifted land can be used as equity

- Interest-only payment options available for 6, 9, or 12 months

- Principal and interest payments begin after the interest-only phase

For more information and frequently asked questions check out our resource on what is required for a construction loan.

Construction Loan Rates

When it comes to financing a new construction project, one of the most critical factors to consider is the interest rate on the construction loan. Construction loan rates can vary widely depending on a variety of factors such as the size of the loan and the length of the loan term. Generally, construction loan rates are higher than rates for traditional mortgages, as they are considered to be riskier for lenders. In the context of construction loan rates, borrowers may be able to lock in a lower rate by securing a fixed-rate construction loan rather than a variable-rate construction loan. It’s also worth noting that borrowers have the option to lock in their rate prior to closing; fees, terms and conditions apply to rate locks. A rate lock secures the rate for the life of a fixed-rate construction loan, even when transitioning from the construction phase to the permanent loan phase. Ultimately, this not only streamlines the process, but removes the stress of a changing rate during construction.

Construction Loan FAQs

What do I need to start the construction loan process?

What is the required down payment for construction loans?

What is the maximum construction loan amount?

Can the land I already own be used as a down payment for a construction loan?

Does a construction loan cover appliances?

How can I get home loans for the house I’m planning to build?

Contact Kennebunk Savings Today!

Learn more about how to get a construction loan directly through our bank to help with any financing you need to purchase land, construct a home, and much more!