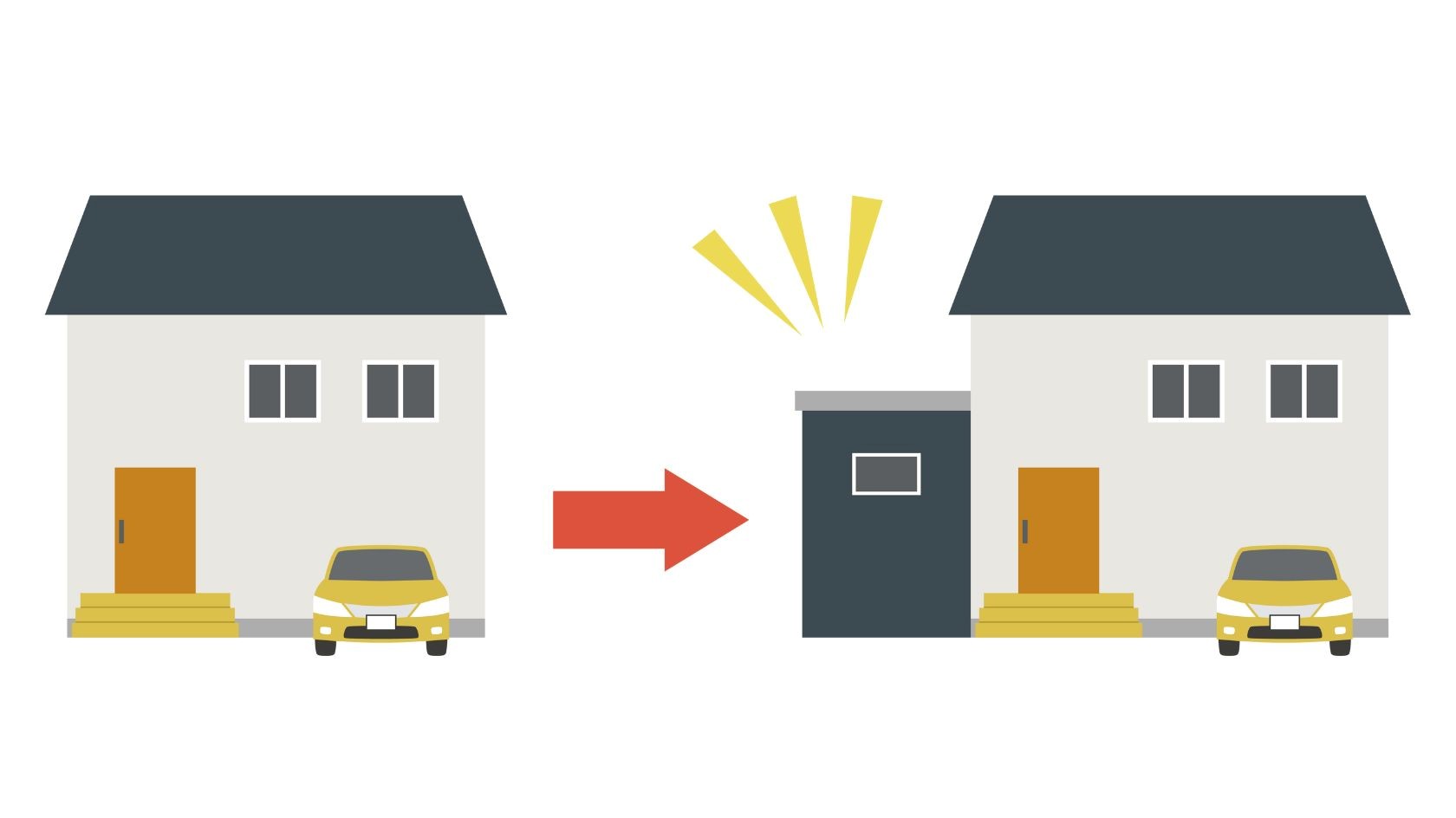

Refinancing your home can be a great move for your long-term financial well-being. You can convert an unpredictable variable rate loan to a fixed rate, reduce your interest rate, extend the term of your loan to make payments easier or fund a home improvement plan with a cash out option.

It’s important to consider your options carefully before you refinance, however, so that the actual cost of refinancing doesn’t negate the financial benefits.

The best course of action is to talk to your local mortgage lender, but first consider doing some research ahead of time.

Here’s a checklist to consider before you try to refinance:

1. What is the Purpose of Refinancing?

What are you hoping to achieve by refinancing? Are you looking for additional cash for home improvements? A lower rate? A lower payment? A shorter or longer term? It’s important that you go to your lender with a goal in mind, so they can help you get there.

2. Has Your Financial Position Improved?

Financial circumstances change, so getting a loan in the past does not necessarily qualify you to get a new one. If your financial position has improved since you purchased your home, that’s an important consideration.

Consider this: In the time since you purchased your home, have any of the following things occurred?

- Your credit score has improved

- Interest rates in your area have dropped

- Your income has increased

- You have paid off another loan or otherwise reduced debt

The basic principles of refinancing are very similar to those of purchasing: the better your financial position, the more options you will have. If you’re in a worse financial position than when you purchased, you might want to take steps to improve your credit score and debt-to-income ratio before you begin the refinancing process.

3. Have You Built Up Enough Equity in Your Home to Refinance?

The good news is that with every mortgage payment, you build equity. If you know that your equity, which is simply the current value of your home minus the mortgage debt you owe on it, is greater than 20% of the current value of your home, it could be a good time to contact a lender you trust and start the refinancing process.

If you haven’t been in your home for very long or didn’t put a lot of money down at the time of purchase, you may not have enough equity yet.

4. Will the Cost of Refinancing be Worth the Savings?

This question can be answered by finding the “break-even point.” Determine your estimated monthly savings from refinancing and the total you’ll be paying in fees and closing costs—refinancing costs can run between 3% and 5% of the loan amount—and then divide that cost by the savings. This is how many months it will take you to recover the cost of refinancing and start seeing the savings.

Use our “Should I Refinance?” calculator to help you determine if refinancing your mortgage is a good idea.

5. How Long Do You Plan to Stay in Your Home?

If your break-even point is not too long, and you plan to stay in your home long enough to actually benefit from that savings, refinancing could be a great way to reduce spending long-term and set yourself up for the future. If you’re planning a move (to a bigger home, downsizing, or relocation) within the next few years, refinancing may not be the right option for you.

6. Are You Happy With Your Current Lender?

If you’ve concluded that you’re ready to refinance your home, you have the opportunity to shop around for mortgage lenders. Look for a lender that will not only find you an excellent rate and term for your refinance, but will care enough to help you through the process.

Ready to talk to a local mortgage expert about refinancing? Contact Kennebunk Savings today.